Trade Ideas Equities

ALGM(NASDAQ), PENG(NASDAQ), PAG(NYSE), BABA(NYSE), LXS(XETR), 8TRA(XETR), FTT(TSX), L(TSX)

Allegro MicroSystems, Inc.-(ALGM/NASDAQ)-Long Idea

Allegro MicroSystems, Inc., together with its subsidiaries, designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems.

The above daily chart formed an approximately 5-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 25.65 levels acts as a resistance within this pattern.

A daily close above 26.42 levels would validate the breakout from the 5-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is 34 levels.

ALGM, classified under the "technology" sector, falls under the “Mid Cap - Growth” stock category.

Penguin Solutions, Inc.-(PENG/NASDAQ)-Long Idea

Penguin Solutions, Inc. engages in the designing and development of enterprise solutions worldwide.

The above daily chart formed an approximately 4-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 21.5 levels acts as a resistance within this pattern.

A daily close above 22.14 levels would validate the breakout from the 4-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is 30 levels.

PENG, classified under the "technology" sector, falls under the “Small Cap - Growth” stock category.

Penske Automotive Group, Inc.-(PAG/NYSE)-Long Idea

Penske Automotive Group, Inc., a diversified transportation services company, operates automotive and commercial truck dealerships worldwide.

The above weekly chart formed an approximately 20-month-long rectangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 180.32 levels acts as a resistance within this pattern.

A daily close above 185.7 levels would validate the breakout from the 20-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 233 levels.

PAG, classified under the "consumer cyclical" sector, falls under the “Large Cap - Growth” stock category.

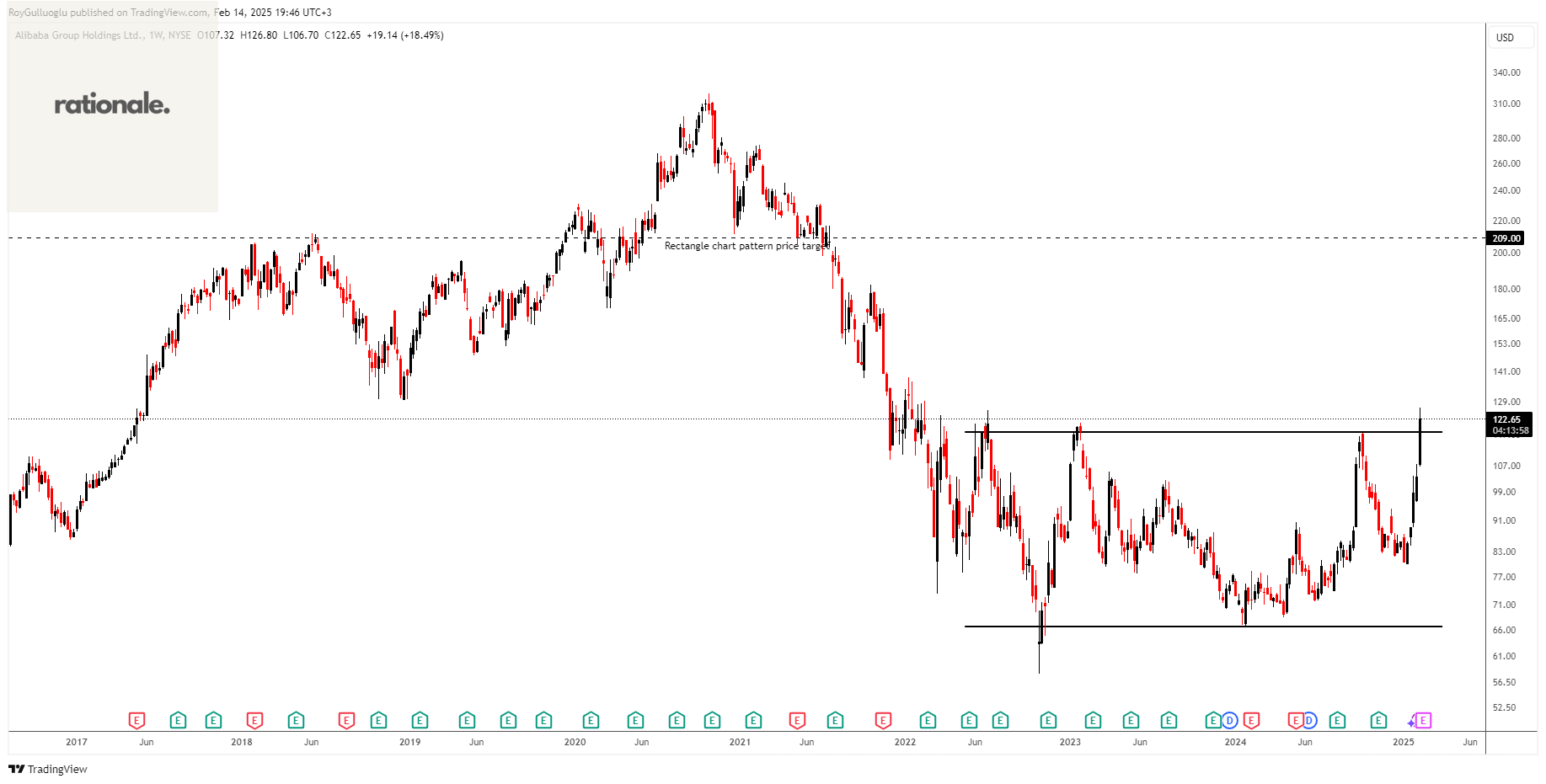

Alibaba Group Holding Limited -(BABA/NYSE)-Long Idea

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

The above weekly chart formed an approximately 36-month-long rectangle chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 118 levels acts as a resistance within this pattern.

A daily close above 121.54 levels would validate the breakout from the 36-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 209 levels.

BABA, classified under the "consumer cyclical" sector, falls under the “Large Cap - Growth” stock category.

LANXESS Aktiengesellschaft-(LXS/XETR)-Long Idea

LANXESS Aktiengesellschaft, together with its subsidiaries, operates as a specialty chemicals company that engages in the development, manufacture, and marketing of chemical intermediates, additives, specialty chemicals, and consumer protection products worldwide.

The above weekly chart formed an approximately 19-month-long rectangle chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 29.66 levels acts as a resistance within this pattern.

A daily close above 30.54 levels would validate the breakout from the 19-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 42 levels.

LXS, classified under the "basic materials" sector, falls under the “Mid Cap - Value” stock category.

Traton SE-(8TRA/XETR)-Long Idea

Traton SE, known as the Traton Group, is a subsidiary of the Volkswagen Group and one of the world's largest commercial vehicle manufacturers, with its Scania, MAN, International, Volkswagen Truck & Bus, IC Bus and Neoplan brands. The company also has digital services branded as RIO.

The above daily chart formed an approximately 5-month-long rectangle chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 32.05 levels acted as a resistance within this pattern.

A daily close above 33 levels validated the breakout from the 5-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 39.6 levels.

8TRA, classified under the "industrials" sector, falls under the “Large Cap - Value” stock category.

Finning International Inc.-(FTT/TSX)-Long Idea

Finning International Inc. sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, Bolivia, the United Kingdom, Argentina, Ireland, and internationally.

The above weekly chart formed an approximately 20-month-long rectangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 45.23 levels acts as a resistance within this pattern.

A daily close above 46.58 levels would validate the breakout from the 20-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 59 levels.

FTT, classified under the "industrials" sector, falls under the “Mid Cap - Value” stock category.

Loblaw Companies Limited-(L/TSX)-Long Idea

Finning International Inc. sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, Bolivia, the United Kingdom, Argentina, Ireland, and internationally.

The above daily chart formed an approximately 2-month-long H&S top chart pattern as a bearish reversal after an uptrend or it might act as a continuation and form an H&S failure chart pattern.

The horizontal boundary at 175.85 levels acts as a support within this pattern while 188 levels act as a resistance.

A daily close below 170.58 levels would validate the breakdown from the 2-month-long H&S top chart pattern. A daily close above 193.64 would validate the breakout from the H&S failure chart pattern.

Based on the chart patterns, the potential price targets are 158.2 and 208 levels respectively.