Trade Ideas Equities

SPOK(NASDAQ), DHI(NYSE), CIGI(NASDAQ), TREE(NASDAQ), LE(NASDAQ), VITL(NASDAQ)

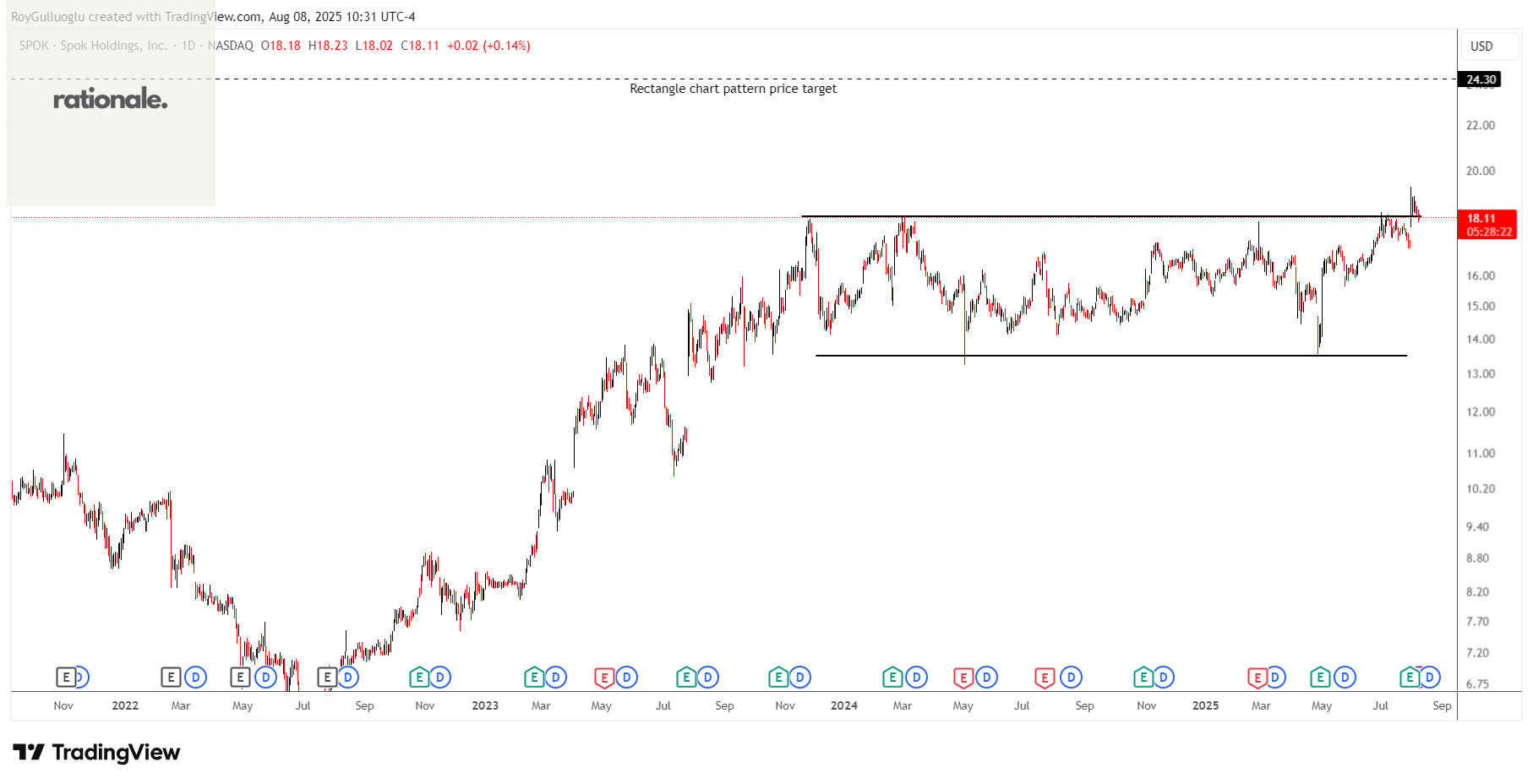

Spok Holdings, Inc.-(SPOK/NYSE)-Long Idea

Spok Holdings, Inc., through its subsidiary, Spok, Inc., provides healthcare communication solutions in the United States, Europe, Canada, Australia, Asia, and the Middle East.

The above daily chart formed an approximately 14-month-long rectangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 18.14 levels acts as a resistance within this pattern.

A daily close above 18.68 levels would validate the breakout from the 14-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 24.3 levels.

SPOK, classified under the "healthcare" sector, falls under the “Small Cap - Value” stock category.

D.R. Horton, Inc.-(DHI/NYSE)-Long Idea

D.R. Horton, Inc. operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States.

The above daily chart formed an approximately 5-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 154.43 levels acts as a resistance within this pattern.

A daily close above 159 levels would validate the breakout from the 5-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is 208.5 levels.

DHI, classified under the "consumer cyclical" sector, falls under the “Large Cap - Growth” stock category.

Colliers International Group Inc.-(CIGI/NASDAQ)-Long Idea

Colliers International Group Inc. provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

The above weekly chart formed an approximately 45-month-long ascending triangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 158.28 levels acts as a resistance within this pattern.

A daily close above 163 levels would validate the breakout from the 45-month-long ascending triangle chart pattern.

Based on this chart pattern, the potential price target is 300 levels.

CIGI, classified under the "real estate" sector, falls under the “Mid Cap - Income” stock category.

LendingTree, Inc.-(TREE/NASDAQ)-Long Idea

LendingTree, Inc., through its subsidiary, operates online consumer platform in the United States.

The above daily chart formed an approximately 5-month-long rectangle chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 55.29 levels acts as a resistance within this pattern.

A daily close above 56.95 levels would validate the breakout from the 5-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 90 levels.

TREE, classified under the "financial services" sector, falls under the “Small Cap - Income” stock category.

Lands' End, Inc.-(LE/NASDAQ)-Long Idea

Lands' End, Inc. operates as a digital retailer of apparel, swimwear, outerwear, accessories, footwear, home products, and uniforms in the United States, Europe, and internationally.

The above daily chart formed an approximately 5-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 13.6 levels acts as a resistance within this pattern.

A daily close above 14 levels would validate the breakout from the 5-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is 23 levels.

LE, classified under the "consumer cyclical" sector, falls under the “Small Cap - Growth” stock category.

Vital Farms, Inc.-(VITL/NASDAQ)-Long Idea

Vital Farms, Inc., a food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

The above daily chart formed an approximately 9-month-long symmetrical triangle chart pattern as a bullish continuation after an uptrend.

A daily close above 45 levels validated the breakout from the 9-month-long symmetrical triangle chart pattern.

Based on this chart pattern, the potential price target is 80 levels.

Teşekkürler Roy