The Allstate Corporation-(ALL/NYSE)-Long Idea

The Allstate Corporation, together with its subsidiaries, provides property and casualty, and other insurance products in the United States and Canada.

The above daily chart formed an approximately 6-month-long rectangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 213 levels acts as a resistance within this pattern.

A daily close above 219.4 levels would validate the breakout from the 6-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 257 levels.

ALL, classified under the "financial services" sector, falls under the “Large Cap - Income” stock category.

Bristow Group Inc.-(VTOL/NYSE)-Long Idea

Bristow Group Inc. provides vertical flight solutions to integrated, national, and independent offshore energy companies and government agencies.

The above weekly chart formed an approximately 50-month-long ascending triangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 40 levels acts as a resistance within this pattern.

A daily close above 41.2 levels would validate the breakout from the 50-month-long ascending triangle chart pattern.

Based on this chart pattern, the potential price target is 79 levels.

VTOL, classified under the "energy" sector, falls under the “Income Cap - Small” stock category.

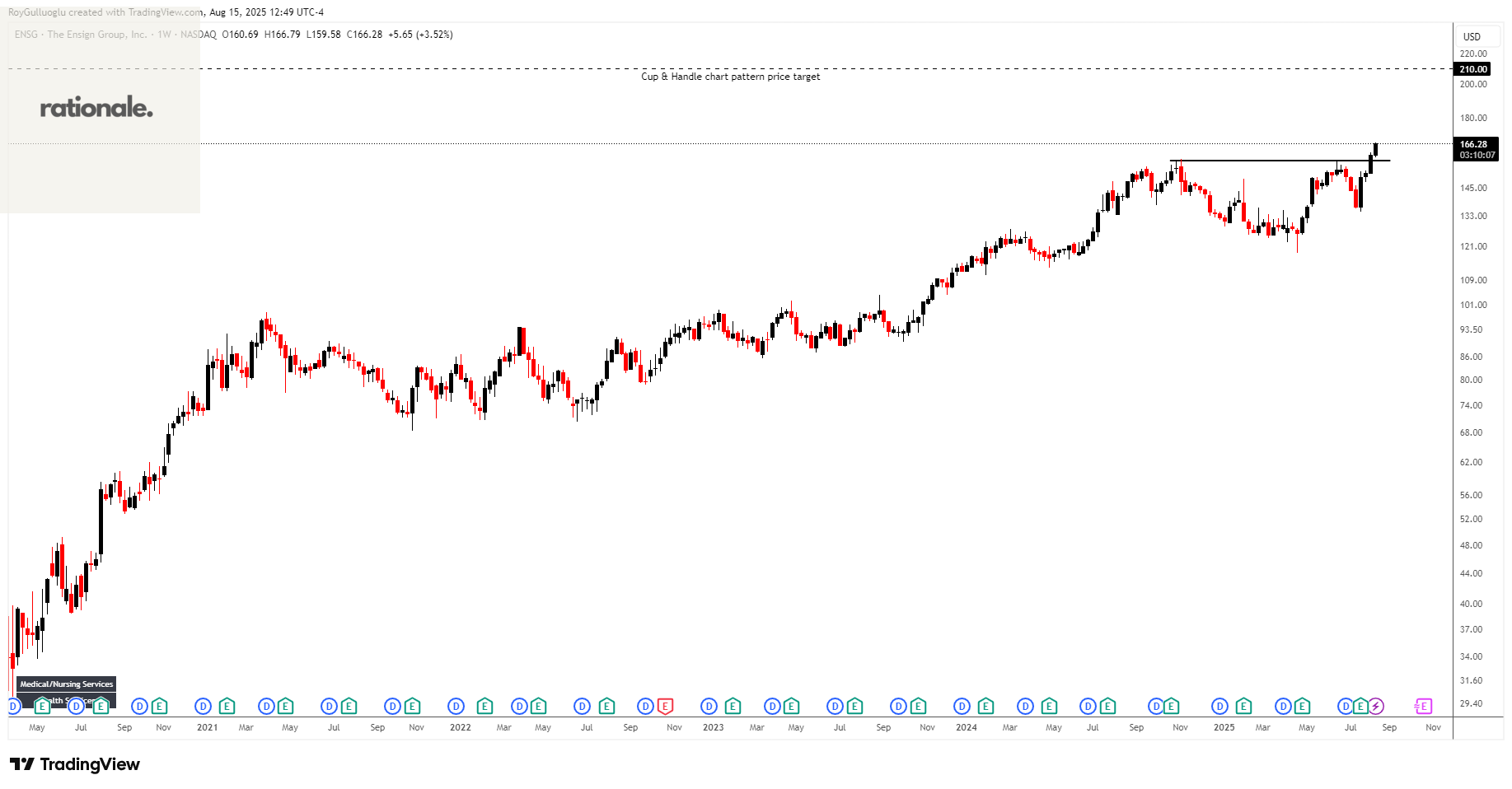

The Ensign Group, Inc.-(ENSG/NASDAQ)-Long Idea

The Ensign Group, Inc. provides skilled nursing, senior living, and rehabilitative services.

The above weekly chart formed an approximately 10-month-long cup & handle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 157.68 levels acted as a resistance within this pattern.

A daily close above 162.4 levels validated the breakout from the 10-month-long cup & handle chart pattern.

Based on this chart pattern, the potential price target is 210 levels.

ENSG, classified under the "healthcare" sector, falls under the “Mid Cap - Value” stock category.

Old Republic International Corporation-(ORI/NYSE)-Long Idea

Old Republic International Corporation, through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

The above daily chart formed an approximately 3-month-long symmetrical triangle chart pattern as a bullish continuation after an uptrend.

A daily close above 39.14 levels would validate the breakout from the 3-month-long symmetrical triangle chart pattern.

Based on this chart pattern, the potential price target is 46 levels.

ORI, classified under the "financial services" sector, falls under the “Mid Cap - Income” stock category.

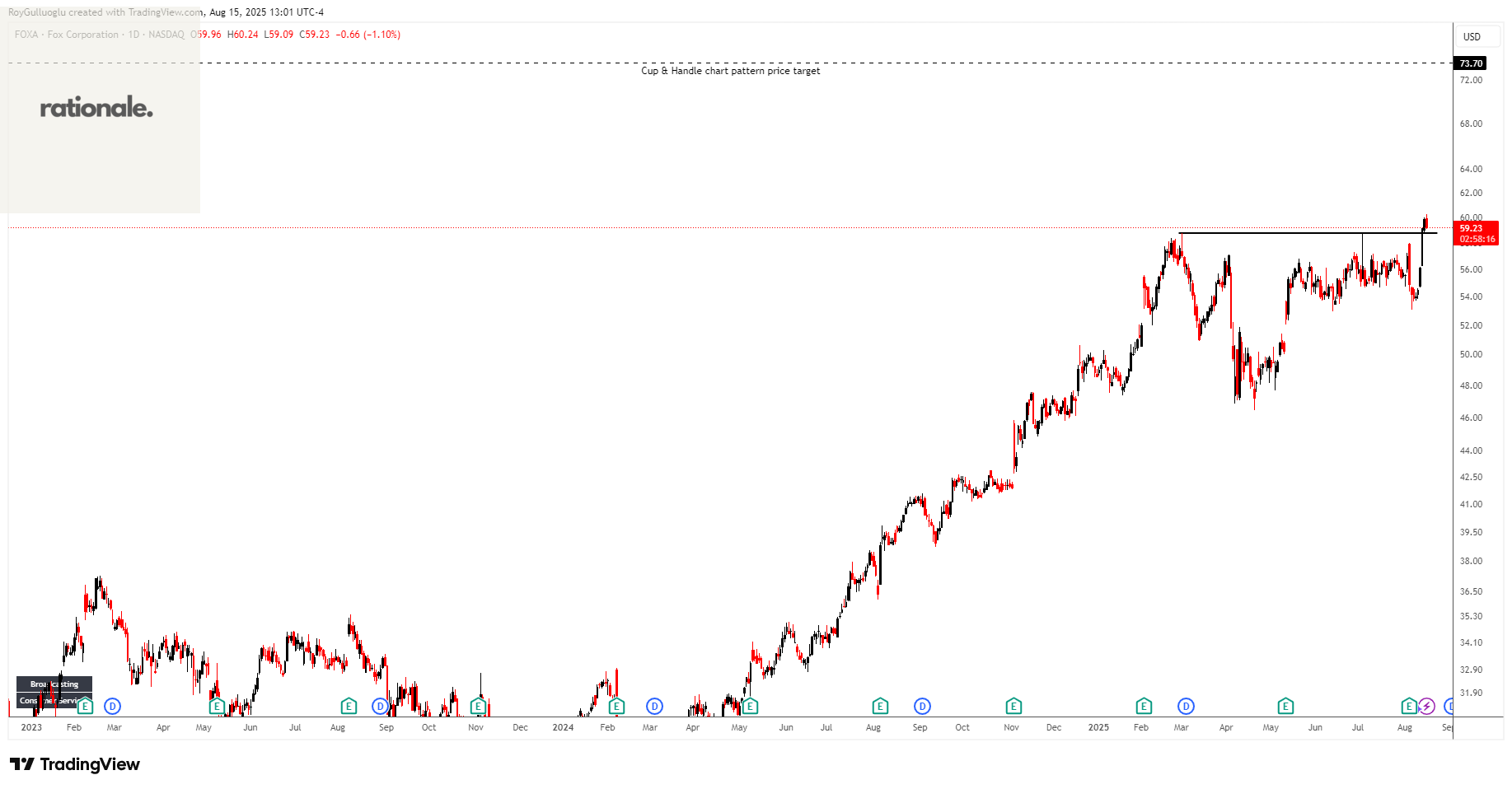

Fox Corporation.-(FOXA/NASDAQ)-Long Idea

Lands' End, Inc. operates as a digital retailer of apparel, swimwear, outerwear, accessories, footwear, home products, and uniforms in the United States, Europe, and internationally.

The above daily chart formed an approximately 4-month-long cup & handle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 58.7 levels acts as a resistance within this pattern.

A daily close above 60.5 levels would validate the breakout from the 4-month-long cup & handle chart pattern.

Based on this chart pattern, the potential price target is 73.7 levels.

FOXA, classified under the "communication services" sector, falls under the “Large Cap - Growth” stock category.

Teşekkürler Roy

Interesting analysis on ENSG! The cup and handle pattern does look pretty convincing here. I've been watching the helthcare sector lately and aging demographics seem like a solid tailwind for skilled nursing facilities. The breakout above 162 is a good sign, though I wonder if the 210 target might take a while to reach given the current market volatilty. What's your timeline on this trade?