GLOBAL MARKETS OVERVIEW

Last week,

US PMI data came in lower than expected. This supports the idea that we are starting to see a "lagged impact" of FED policies. European PMI came better than expected, Europe is behind the US on the tightening path.

On Tuesday, JOLTS Job opening data came in lower than expected, meaning that fewer companies are looking for workers than expected. Made us question FED's view on a robust economy.

On Wednesday ADP non-farm data came below the expectation. In addition to bad JOLTS data, another bad data for the real economy led to a decrease in the rate increase probabilities. The market’s reaction made me think of the shift from “decrease in rate hikes probabilities - good for risky assets” to “bad data-higher recession risks-sell risky assets”.

On Wednesday non-Manufacturing PMI data came lower than the expectation. This revived the recession fear and caused negative pricing in risky assets.

On Friday(07/04),

US Non-Farm Payrolls MAR: Actual:236K, Forecast:230K, Previous:311K

236K payroll is lower than the average for the last six months(334K) and 3 months(345K). There is a clear downtrend on the payroll side as FED suggested. In that regards the data is in line with the FED’s expectations.

US Participation Rate MAR: Actual:62.6%, Previous:62.5%

The participation rate has slightly increased, as per the FED's plan to boost labor supply and mitigate the risk of inflation caused by high wages. The FED has also previously stated that combating inflation requires increased unemployment(soft landing), which can also be achieved by a higher labor supply. In that regard, an increasing participation rate would also be another indication that we might be close to the end of the tightening cycle.

US Avg Hourly Earnings MoM MAR: Actual:0.3, Forecast:0.3%, Previous:0.2% US Avg Hourly Earnings YoY MAR: Actual:4.2%, Forecast:4.3%, Previous:4.6%

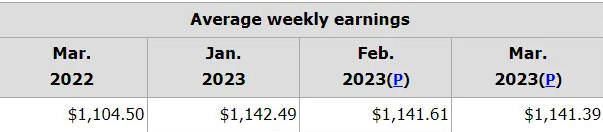

Despite the monthly data coming parallel to the expectation we saw an important decrease in yearly data. This is a good sign of mitigating the risk of sticky inflation. Also, as shown in the table below, the weekly earnings have been decreasing for 3 consecutive months.

Overall, the nonfarm data supports the idea of soft landing which means that we are getting closer to the end of the tightening cycle.

But, this shouldn’t be understood that we should see immediate positive pricing in risky assets because we have an upcoming FED meeting with the expectations of a 25 bp rate hike. With the current environment, I expect to see short-term limited negative pricing in risky assets due to the ongoing tightening cycle, followed by medium-term positive pricing thanks to the soft landing.

The current technical level of DXY also supports this idea. I wouldn’t be surprised if I see a rejection from 102$ level since it's a critical support level on the monthly DXY graph.

The possible rejection of DXY from the 102$ level coincides with the important resistance of the ES1! As you can see below. You can see my potential expectation for SP 500 in the below graph.

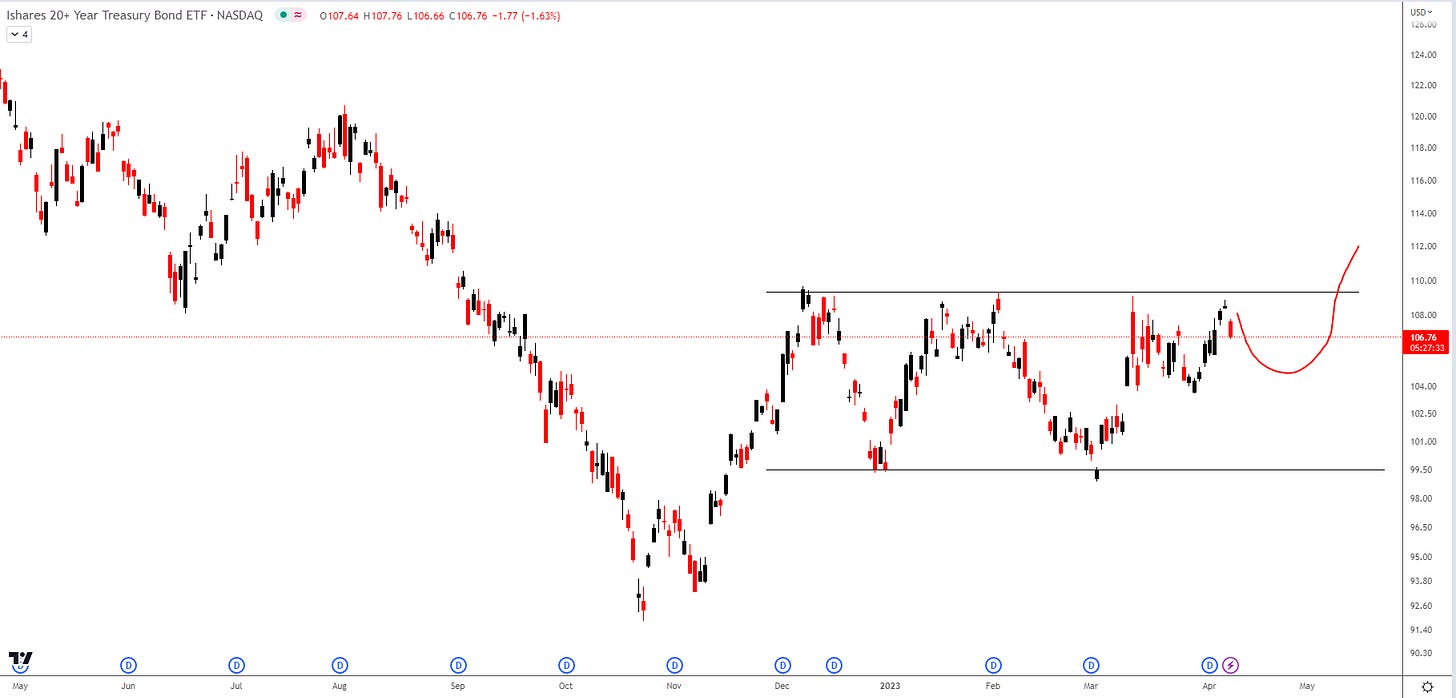

Also with the upcoming rate increase, we could expect to sell off bonds in aiming of getting bonds with higher returns. The below “20+ years bond ETF - TLT” is also trading at a crucial 109.3 $ resistance level where we can see a slight rejection due to a rate increase.

Let’s finally add Bitcoin to the basket. As you can see BTC is having difficulty passing the 28600 $ level which is a crucial old support new resistance level. With an expectation of “short-term negative pricing in risk assets”, I would expect a limited retracement on Bitcoin and then a relief with the “soft landing”. Bear in mind that the case of BTC has a few layers since it also acted parallel to Gold in the recent SVB banking crisis.

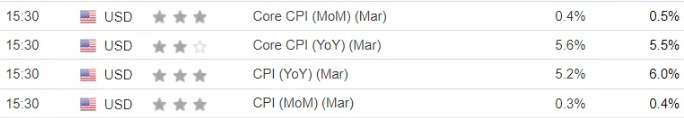

On upcoming inflation data,

If the upcoming inflation data comes surprisingly below expectation there is a possibility of skipping fast the “short-term negative pricing in risk assets” that I mentioned above or vice versa if it comes aggressively higher than expected the potential “short-term negative pricing in risky assets” may take longer than we think.

Great update!