CALENDAR

Tuesday (19/09)

EU CPI YoY AUG: Actual: 5.2%, Forecast: 5.3%, Previous: 5.3%

US building permits AUG: Actual: 1.543M, Forecast: 1.440M, Previous: 1.443M

Wednesday (20/09)

UK CPI YoY AUG: Actual: 6.7%, Forecast: 7.0%, Previous: 6.8%

EU ECB member speeches

US FOMC economic projections

US FED interest rate decision: Actual:5.5%, Forecast: 5.5%, Previous: 5.5%

Thursday (21/09)

UK BoE interest rate decision: Actual:5.25%, Forecast: 5.5%, Previous: 5.25%

US Philly FED manufacturing index SEP: Actual:-13.5, Forecast: -1.0, Previous: 12.0

US Existing home sales AUG: Actual: 4.04M, Forecast: 4.1M, Previous: 4.07M

JP BoJ interest rate decision: Actual: -0.1%, Forecast: -0.1%, Previous: -0.1%

MACRO

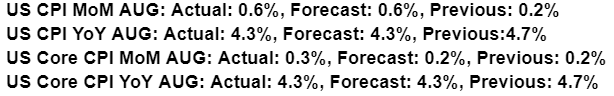

CPI numbers:

13/09 US CPI data came in slightly above expectations on a monthly basis but in line with expectations on an annual basis. Core inflation data was also above expectations MoM, while in line with expectations YoY.

YoY core good inflation change is 0.2%. The downtrend continues.

There is also a continuation of the downtrend of core service inflation.

Core goods inflation is influenced by short-term inflation expectations and import prices. Core services inflation is influenced by long-term inflation expectations and the level of demand and supply in the domestic labor market.

The YoY change in the super core inflation(Core services-shelter) is 4.5%, and 0.37% in MoM. There is a slight increase in the MoM data but the YoY data is flat.

Contrary to the market expectations, the ECB raised the rates by 25 bp points to the 4.5% level.

“ Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

The above statement signals the end point of ECB rate increases is soon.

It also means that they would favor keeping the reached level of rates for a long time rather than increasing it more. We see the impact of this situation on EURUSD pricing.

PRE-MEETING: FED officials are set to hold interest rates steady but the discussion is the potential cost of lifting rates again this year.

Projections on rates will be influential on market pricing. The dot plot will show FED members’ views on 2024 rates. We need to monitor if the projections made in June are in line with the new ones. An additional rate hike is needed to match the projections made in June.

Since an additional rate hike is still on the table with the current macroeconomic circumstances, "the new dot plot" would be in line with the June projections in which the median projection is an additional rate hike until the end of the year.

Also when you compare projecting one more rate hike and opting out a rate hike, the former one is a lot easier from the communication perspective. Especially in an environment where the headline inflation increased due to gas prices.

We might expect to see fewer officials’ votes on the team “additional hike” because the current debate is whether to favor maintaining high-interest rates or increasing the rates more as it happened on ECB.

We also need to pay attention to the 2024 rate projections to evaluate the potential length of the high-interest rates. In the last projection, the median forecast was between the 4.5% - and 4.75% range.

Expecting a cautiously optimistic tone from Powell makes sense amid the current environment. Probably we are going to hear “We are not done yet”

AFTER THE FED MEETING: Federal Reserve officials voted to hold interest rates steady at 5.5%

Revised GDP and Unemployment Projections: The upward revisions in the median Real GDP and unemployment projections for 2023 and 2024 suggest that the Fed views the economy as resilient. This provides them with the flexibility to consider future rate hikes if necessary. It's important to note that the Fed often uses these projections as key factors in its policy decisions.

PCE Inflation Projections: The upward revision of the median Personal Consumption Expenditures (PCE) inflation projections for 2023 signals that inflation remains a concern for the Fed. This suggests the possibility of further rate hikes in 2023 to combat inflationary pressures.

Federal Fund Rate Projections and Dot Plot: The Fed's decision to revise the federal fund rate projections upwards aligns with their inflation expectations. The dot plot indicates that the Fed anticipates a prolonged period of relatively high-interest rates.

Duration of high rates: The main discussion had been the highest level of the rates until now. As highlighted in the analysis, the duration of these high rates is a significant consideration for financial markets.

Hawkish Tone and Risks: The Fed's persistence in a hawkish tone suggests that they will continue to prioritize controlling inflation. The analysis rightly points out potential risks, including a government shutdown(budget dispute), student loan repayments, labor strikes, and rising gas prices.

Powell's Comments: Powell's comments about the Fed's base scenario and the concept of a "soft landing" introduce an element of uncertainty. He first replied that the `soft landing` is not their base scenario then he said that they are trying to make the soft landing real.

Soft Landing Expectations: The reference to a "soft landing" as the base scenario implies that the Fed aims to engineer an economic slowdown without triggering a recession. If negative economic data emerges, it could lead to speculation of a "Fed pause" on rate hikes to avoid damaging economic growth, which would lead to a decrease in rates and DXY.

BOE interest rate decision: The decision to keep the interest rate unchanged at 5.25% reflects the central bank's cautious approach. The fact that five out of nine members voted to maintain rates, despite four members advocating for an increase, indicates a divided sentiment within the central bank's decision-making body.

Core CPI Decline: The decline in the core CPI from 6.9% to 6.2% for August suggests some moderation in inflationary pressures even though wage inflation remains high. The declining inflation numbers had decreased the probability of a rate hike for the meeting.

Balance sheet reduction and a potential shift in monetary policy: The ongoing decision to reduce the size of the balance sheet by 100 billion pounds in one year is an indication of BoE`s commitment to tightening its monetary policy and draining liquidity from the financial system but the decision not to raise rates after 14 consecutive rate hikes signal a potential shift in monetary policy stance. it suggests that the central bank may be more careful about other economic factors beyond inflation.

Market expectations for future rate hikes: The market is pricing a 25 basis point hike for the rest of the year at around 55%.

In summary, despite elevated inflation, growth-based risks have played a significant role in shaping the central bank's rate decision.

BOJ did not change the policy rate and maintained the yield curve control.

Despite Japan`s core CPI being well above its 2% target, the BoJ maintained a loose monetary policy.

As you can see in the 5th article below, they want to maintain the 3.1% level of core inflation with the accompanying wage increases. Contrary to other central banks, the BoJ needs relatively sticky inflation.

Before the meeting, the market was expecting a potential signal of shifting from the yield curve control since the inflation numbers have already come well above the target. Accordingly, we saw positive pricing on JPY against other currencies. However, expectations were not met and JPY moved back to its pre-meeting levels.