GLOBAL MARKETS OVERVIEW

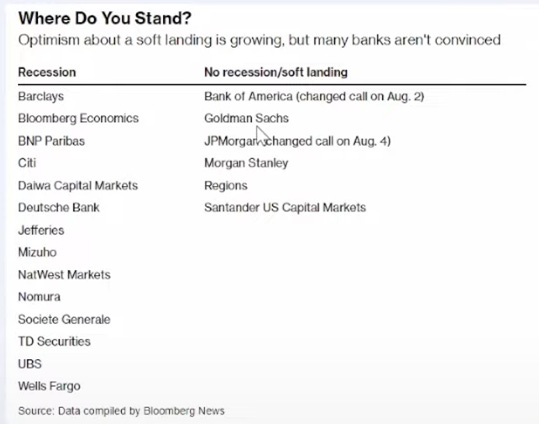

The main topic of 2023 was the “Soft Landing”. With the recent data flow, the market started to be convinced. The below table shows banks’ views on the recession.

So what’s threatening the soft landing scenario lately??

The data flow from China has been signaling an economic slowdown lately. The evergrande solvency issue in the real estate industry, shadow banking industries newsflow, industrial production data, retail sales, and recent disinflationist structure.

As a result of that, PBoC had decided to cut one-year loan rates by 15 basis points on August 15 as part of the support package. In addition to that, on 21/08, they cut the prime rate by 10 basis points. The expectation was 15 basis points. Since they also need to protect Yuan from devaluation, they can not be aggressive enough on rates. Selling USD in the UK market is another tool that they employ for protecting the Yuan.

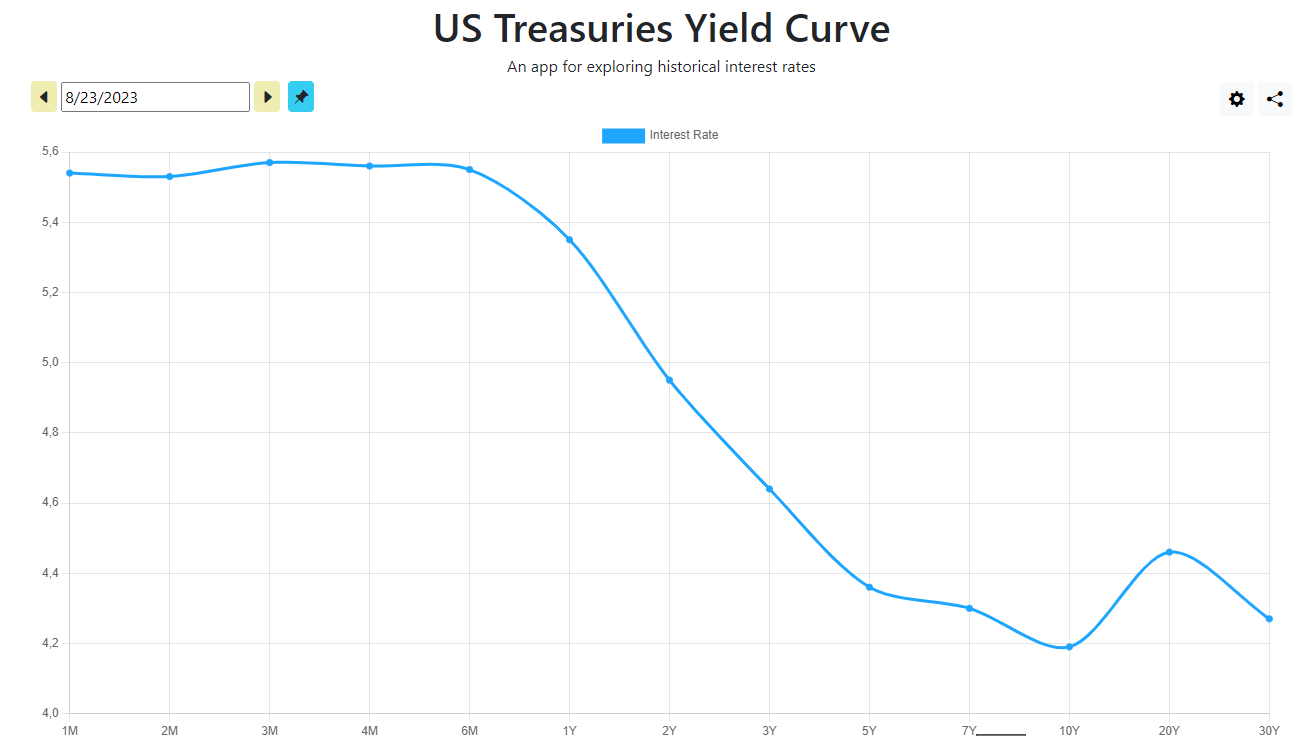

Apart from the China side, another indicator of recession is the yield curve inversion which is another hot topic that drives market pricing lately the most.

So when we see an inversion, it means that the short end of the yield curve is higher than the long end of the yield curve. That means short-term credit conditions are getting tighter and it makes it difficult to finance the growth. Banks borrow short and lend long. When the yield curve inverts there is no profit for banks because borrowing costs become higher than lending rewards. That leads to a recession.

However, we have been observing reverse back moves from an inverted yield curve to a normal yield curve for a few weeks. We have seen an increase in both yield curves but more on the long end of the curve which signals a normalization.

When the above graph increases, it means that 10y yields rise more than 2y yields. It could be considered as “normalization”. Considering the Fed’s 2% percent inflation target, seeing a normalization of around 3% inflation levels, raised concerns of a new normal that is similar to pre-2008 when high interest rates were normal.

The market might be pricing that soft-landing will occur around the current inflation levels which are higher than the Fed’s target. Then they might be saying that if we are going to normalize around these levels, the current yield is not attractive so let’s sell the bond market.

To evaluate the validity of this scenario I would like to watch US indices closely because if a scenario is sourced by “soft-landing” or “no recession”, we would naturally expect strength in US equities despite the price action on the yields.

At some point, I might expect a shift from the “high yields, low indices” structure, especially on the equities side. As we see further reverse back from an inverted yield curve, it will increase the probability of a “no recession” scenario.

Accordingly, we will need to monitor China closely to evaluate recession probabilities and their impact on the yield curve.

Amid the above structure,

23/08 weak PMI data led to a decline in the market's expectations for a more aggressive Fed rate, reversing the recent uptrend of the yields.

With the support of NVDA earnings, US equities outperformed.

Newsflow from the Jackson Hole Symposium will be influential in determining the direction of the market.

Thank you so much.