Retail Sales Data

Retail sales exceeded expectations, particularly in the online market. This could limit any potential downward revisions to the NFP numbers, which would be positive for the economy. While a November rate cut still seems likely, the December decision remains uncertain, with projections expected. The upcoming NFP release will play a crucial role on especially December rate decision and projections.

Interest Rates and Market Sentiment

Strong retail sales have sustained high rates, a critical trend to watch. Additionally, geopolitical risks, upcoming election uncertainty, and recent inflation concerns (highlighted by the latest CPI data) could pause the downward trend in yields. Key upcoming dates include the U.S. election on November 5th and the Fed meetings on November 6th and 7th.

I'm using the TLT chart to track long-term bond yields. It's currently at a crucial technical level—if the trendline acts as a support, we could see a continued decline in yields. Remember that long-term yields go up when the attached TLT chart goes down.

Equity Market Strength Despite High Yields

Despite high yields, equities continued to rise last week. This could be attributed to three main factors:

a) Strong earnings expectations as we received some from banks. Banks collectively provided strong guidance on their outlooks, which drove the KWB Bank Index higher.

b) Markets potentially pricing in a Trump victory, which institutional investors see as positive for stocks and negative for bonds, in contrast to a Kamala Harris victory.

c) Additionally, a third reason for broad market strength could be the equity rally expanding beyond the Magnificent Seven to include the broader S&P 500, as well as mid-cap and small-cap stocks.

S&P 500 Forecast and Long-Term Outlook by Goldman Sachs

I came across an analysis in John Authers’ daily newsletter, which provides further insight into the current market dynamics. Goldman Sachs’ chief US equity strategist, David Kostin, raised his year-end S&P 500 forecast to 6,000, with a 12-month target of 6,300, suggesting a potential 11% gain over the next year. However, he also warned that long-term growth may be much slower.

In a follow-up report, Kostin estimates that the S&P 500 will gain only 3% per year in nominal terms (1% in real terms) over the next decade, which would be one of the weakest performances on record.

Short-term optimism is driven by the recent 10% rally in the S&P 500, largely based on growing market belief in Donald Trump’s potential return to the White House and a relatively strong earnings season. Earnings forecasts have been manageable, and Goldman expects profit margins to continue expanding. Additionally, Goldman has a slightly more positive view of the economy compared to the broader market consensus. In short, they are optimistic only for a short term.

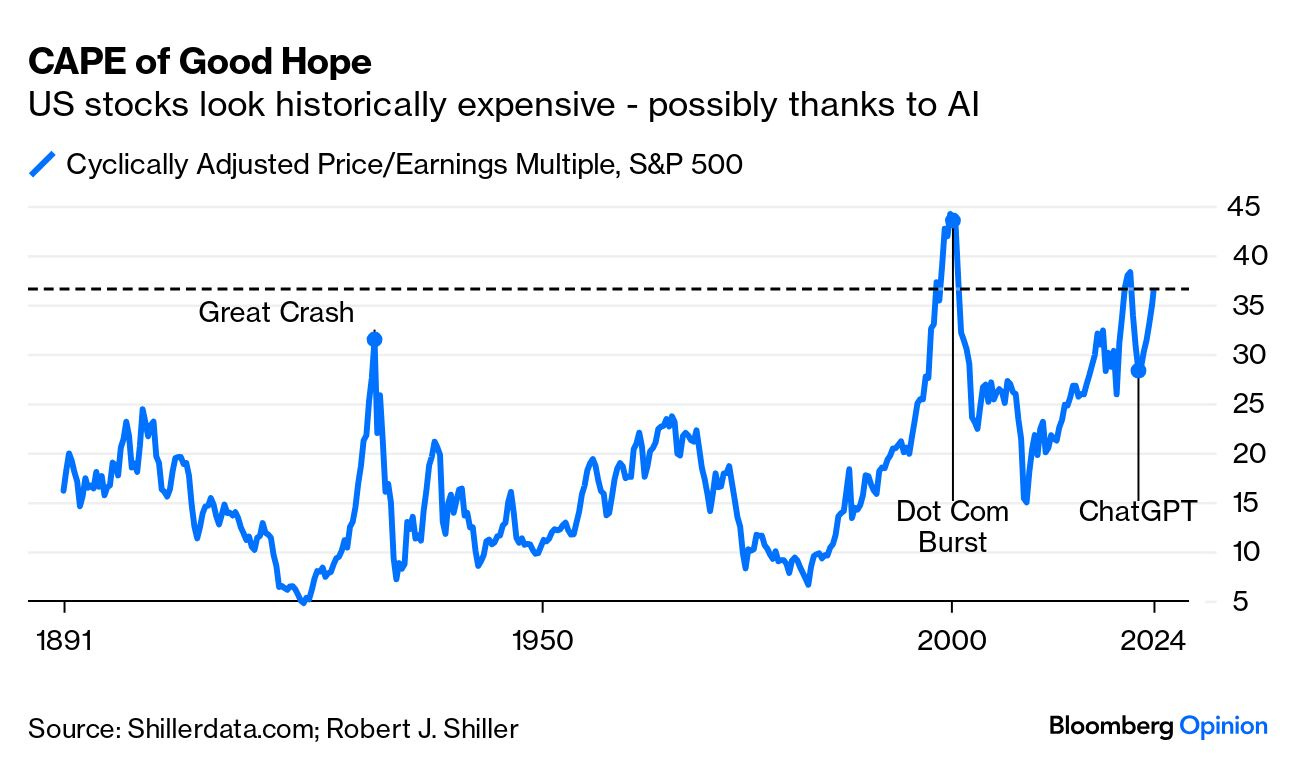

For the long term, valuation is key. The CAPE (Cyclically Adjusted Price-to-Earnings) ratio, which compares current stock prices to inflation-adjusted earnings from the past 10 years, shows that the S&P is currently more expensive than it was before the Great Crash of 1929 and not far from levels seen during the dot-com bubble of 2000.

Historically, when the CAPE peaked, it often led to a significant decline over several years, but this time the CAPE peaked in 2021 and bounced back by late 2022—coinciding with the launch of ChatGPT. The ongoing AI boom seems to be playing a major role in keeping the market elevated despite historical trends suggesting a potential downturn.

To wrap-up…

I don't view Goldman’s warning as a bear market signal, but it aligns with my belief that there may be limited upside left for U.S. equities and stocks in general. As John Authers explained, the concern is about valuation, which is a long-term issue. However, it’s essential to remain cautious and avoid falling into the trap of FOMO. Stick to the rules you've set and carefully analyze the charts for signs of a potential downturn. As we all know, the biggest challenge is filtering out the noise and maintaining discipline in our approach. In conclusion, staying focused on your strategy and avoiding emotional decisions is key to navigating these uncertain times.

Wishing you all a productive and successful week ahead!