Dear Rationale Members,

In the ever-changing landscape of the financial markets, it’s easy to get swept up in common narratives—one of which is that rising yields inevitably spell trouble for stocks. But as always, our goal is to look deeper and understand the nuances shaping these relationships. Here’s a closer examination of the factors impacting yields, providing insight beyond the headlines.

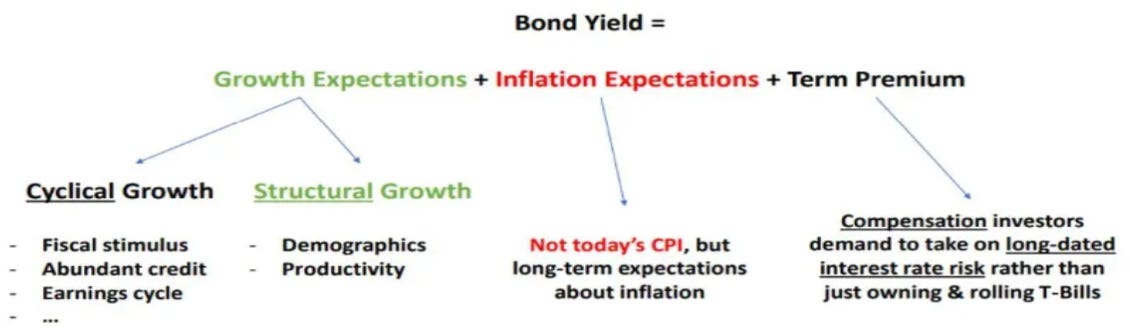

Key Factors Driving Yields

Growth Expectations

Structural Growth: Long-term economic growth is driven by factors like labor force expansion (positive demographics) and productivity improvements. These support stronger structural growth, leading to higher long-dated bond yields. For example, recent enthusiasm around AI has fueled expectations of significant productivity gains, supporting a narrative of higher structural growth.

Cyclical Growth: Short-term growth cycles are influenced by the credit cycle, fiscal policies, earnings, and labor market trends. As an example, in healthy economic cycles, short-term yields can increase, often influenced by central bank tightening to curb overheating and inflation. Another example, monetary policy adjustments directly affect yield levels and EPS expectations. investor caution.

Inflation Expectations

When inflation expectations rise, investors seek higher yields to protect their purchasing power against potential future inflation. As a result, they tend to sell current bonds and wait for new issuances with higher yields that better offset inflation risks. This shift drives down bond prices, which in turn pushes yields higher.

Term Premium

The term premium represents the compensation investors demand for holding long-term bonds over rolling short-term instruments, like 3-month T-bills. Higher uncertainty, such as that surrounding the upcoming U.S. election, generally raises the term premium, which in turn can drive up long-dated yields.

Higher Yields Aren't Always Negative for Stocks

With these factors in mind, remember that higher yields don’t always spell trouble for stocks. Instead, understanding why yields are rising can help us interpret their broader implications. The relationship between the SPX and US 10-year yields varies across each period in the chart, with each period driven by distinct underlying factors. For instance, despite the current election uncertainty pushing yields higher, the stock market remains supported by a strong earnings season and a positive inflation trend (despite the latest CPI data). This aligns with a “soft landing” scenario, which remains the base case for the current market outlook.

As we continue to monitor these developments, let’s keep our eyes on the bigger picture. Rising yields, in the right context, can reflect underlying economic strength, which isn’t inherently negative for equities.

Let’s keep questioning the narratives, exploring the factors at play, and keeping a steady course as we navigate this landscape together.

Warm regards,

Roy