Last Week’s Key Developments

Nonfarm Payroll Report: No Major Shift from Soft Landing Narrative

Headline payrolls came in at 151K, slightly below expectations but largely in line.

Wage-based inflation risks did not increase, supporting Powell’s view that the labor market is no longer fueling inflation.

Broad unemployment (U-6)(includes part-time employers) jumped to 8.0% from 7.5%, the highest since October 2021, indicating some labor market strain.

The government sector saw a 10K decline, which is expected to deepen in March due to DOGE-related factors.

Remember that government sector hiring was supporting the labor market a lot. There might be more room to bear such negative numbers.

Private sector job growth slowed, with the three-month average declining from 204K to 169K, still supporting the soft landing thesis despite the decline as 169K is a strong figure.

Conflicting PMI Data: ISM vs. S&P Global

S&P Global PMI (includes broader job titles such as CEOs and CFOs) signaled a slowdown in the services sector while manufacturing remained weak.

ISM Services PMI (based on purchasing and supply executives) did not confirm the services slowdown seen in S&P data.

Trump-related risks, such as potential tariffs, are impacting sentiment. Companies may have to squeeze profit margins instead of passing costs onto consumers.

Germany’s Expansionary Fiscal Reforms

A €500 billion infrastructure fund, equivalent to 11.6% of GDP, will be spent over 10 years, with €100 billion allocated to federal states.

Defense spending will be exempt from debt limits, allowing military expenditure to exceed 1% of GDP, with projections that it could reach 3%.

Increased bond issuance could push yields higher, which may either support or weaken the euro depending on market perception.

If fiscal expansion fuels inflation, the ECB may be forced to tighten policy, but excessive debt issuance without strong growth could pressure the euro lower.

ECB Cuts Rates Again but Faces Uncertainty

The European Central Bank delivered its sixth rate cut since June, but future policy direction remains uncertain.

Rising defense spending amid the possibility of a reduced US commitment to Ukraine could complicate inflation dynamics.

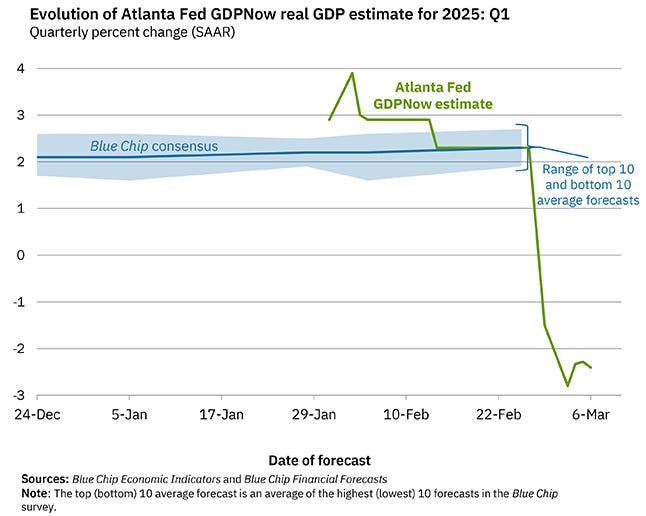

Fed and Growth Outlook

The Atlanta Fed’s Q1 GDPNow estimate turned negative, primarily due to a surge in gold imports widening the trade deficit.

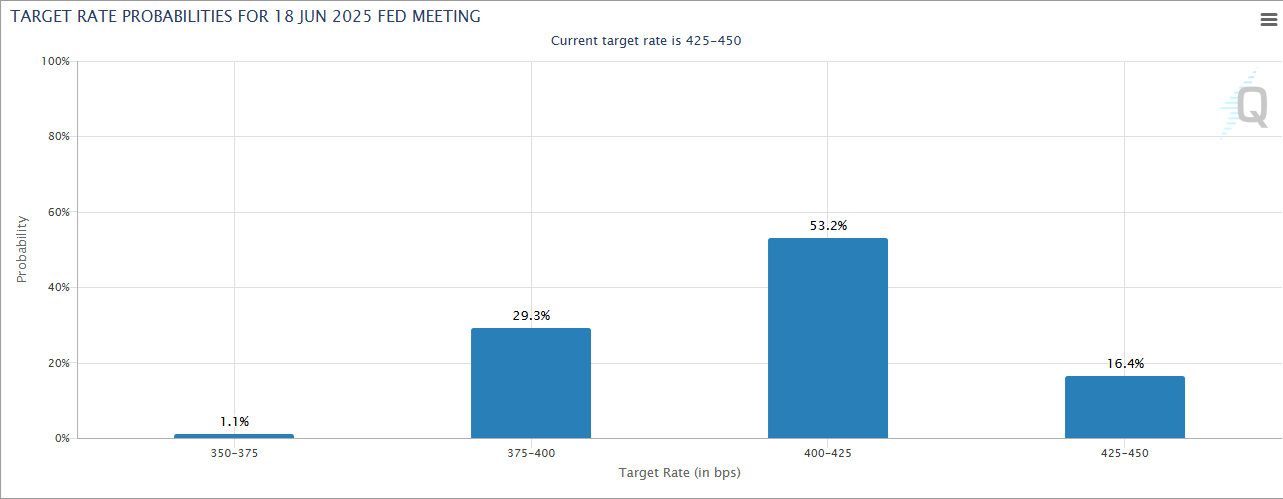

Markets still expect three Fed rate cuts this year, but actual cuts will depend on labor market weakness.

According to FactSet earnings expectations are falling. S&P 500 Q1 EPS estimates dropped 3.5%, a sharper-than-average decline, largely due to tariff and inflation concerns.

Japan Declares End to Deflation

All four key indicators—output gap, CPI, GDP deflator, and unit labor costs—turned positive.

The output gap flipped in Q4 2024, reinforcing expectations for a Bank of Japan rate hike.

This Week’s Market Themes

Recession Fears Are Rising

Wall Street is increasingly concerned that Trump’s economic policies could derail the soft landing.

Monday’s selloff was the worst for the S&P 500 this year, led by tech. The VIX spiked to 28, reflecting increased risk aversion.

JOLTS Data Higher Than Expected but Had Limited Market Impact

Trump’s Tariff Moves and Market Reaction

A 50% tariff was announced on all steel and aluminum from Canada.

The US dollar weakened against most major currencies but gained against the Canadian dollar.

The euro strengthened, supported by German fiscal stimulus expectations.

Inflation Report Will Play a Crucial Role

According to FactSet the median estimate for the year-over-year consumer price index (CPI) for February 2025 is 2.9%.

If the actual CPI matches expectations, it would mark a decrease from January’s 3.0% and fall below the trailing 12-month average of 3.0%.

Inflation has exceeded estimates in four of the last 12 months, suggesting some risk of an upside surprise.

A weaker-than-expected CPI print would strengthen Fed rate cut expectations, while an upside surprise could delay policy easing.

This week’s price action will largely depend on how inflation data evolves, the Fed’s policy outlook, and ongoing tariff uncertainty.

Best,

Roy Gulluoglu

Founder, Rationale