New setups

Upwork, Inc.-(UPWK/NASDAQ)-Long Idea

Upwork Inc. and its affiliated companies manage a professional marketplace facilitating connections between businesses and independent professionals and agencies across the United States, India, the Philippines, and globally.

The above daily chart formed an approximately 4-month-long H&S continuation chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 15.6 levels acts as a resistance within this pattern.

A daily close above 16.06 levels would validate the breakout from the 4-month-long H&S continuation chart pattern.

Based on this chart pattern, the potential price target is 23 levels.

UPWK, classified under the "industrials" sector, falls under the “Small Cap - Value” stock category.

Hercules Capital, Inc.-(HTGC/NYSE)-Long Idea

Hercules Capital, Inc. is a business development company specializing in providing financial solutions like venture debt, senior secured loans, and growth capital. They serve privately held venture capital-backed companies at various stages, including startups and established-stage firms, along with select publicly listed and special opportunity lower middle market companies seeking additional capital for acquisitions, recapitalizations, refinancing, and overall growth.

The above daily chart formed an approximately 4-month-long Cup & Handle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 17.94 levels acted as a resistance within this pattern.

A daily close above 18.47 levels validated the breakout from the 4-month-long Cup & Handle chart pattern.

Based on this chart pattern, the potential price target is 21.18 levels.

HTGC, classified under the "financial services" sector, falls under the “Mid Cap - Income” stock category.

Sherwin-Williams Company(The)-(SHW/NYSE)-Long Idea

The Sherwin-Williams Company is involved in the production, distribution, and sales of paints, coatings, and related products, catering to professional, industrial, commercial, and retail customers.

The above daily chart formed an approximately 2-month-long H&S continuation chart pattern as a bullish continuation after an uptrend.

Within this pattern, the horizontal boundary at 314 levels acts as a resistance.

A daily close above 323.4 levels would validate the breakout from the 2-month-long H&S continuation chart pattern.

Based on this chart pattern, the potential price target is 335 levels.

SHW, classified under the "basic materials" sector, falls under the “Large Cap - Value” stock category.

Pioneer Natural Resources Company-(PXD/NYSE) - Long Idea

Pioneer Natural Resources Company functions as an independent oil and gas exploration and production company within the United States. The company engages in the exploration, development, and production of oil, natural gas liquids (NGLs), and gas.

The above daily chart formed an approximately 2-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The boundary at 234.63 levels acts as a resistance within this pattern.

A daily close above 241.6 levels would validate the breakout from the 2-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is 257.3 levels.

PXD, classified under the "energy" sector, falls under the “Large Cap - Income” stock category.

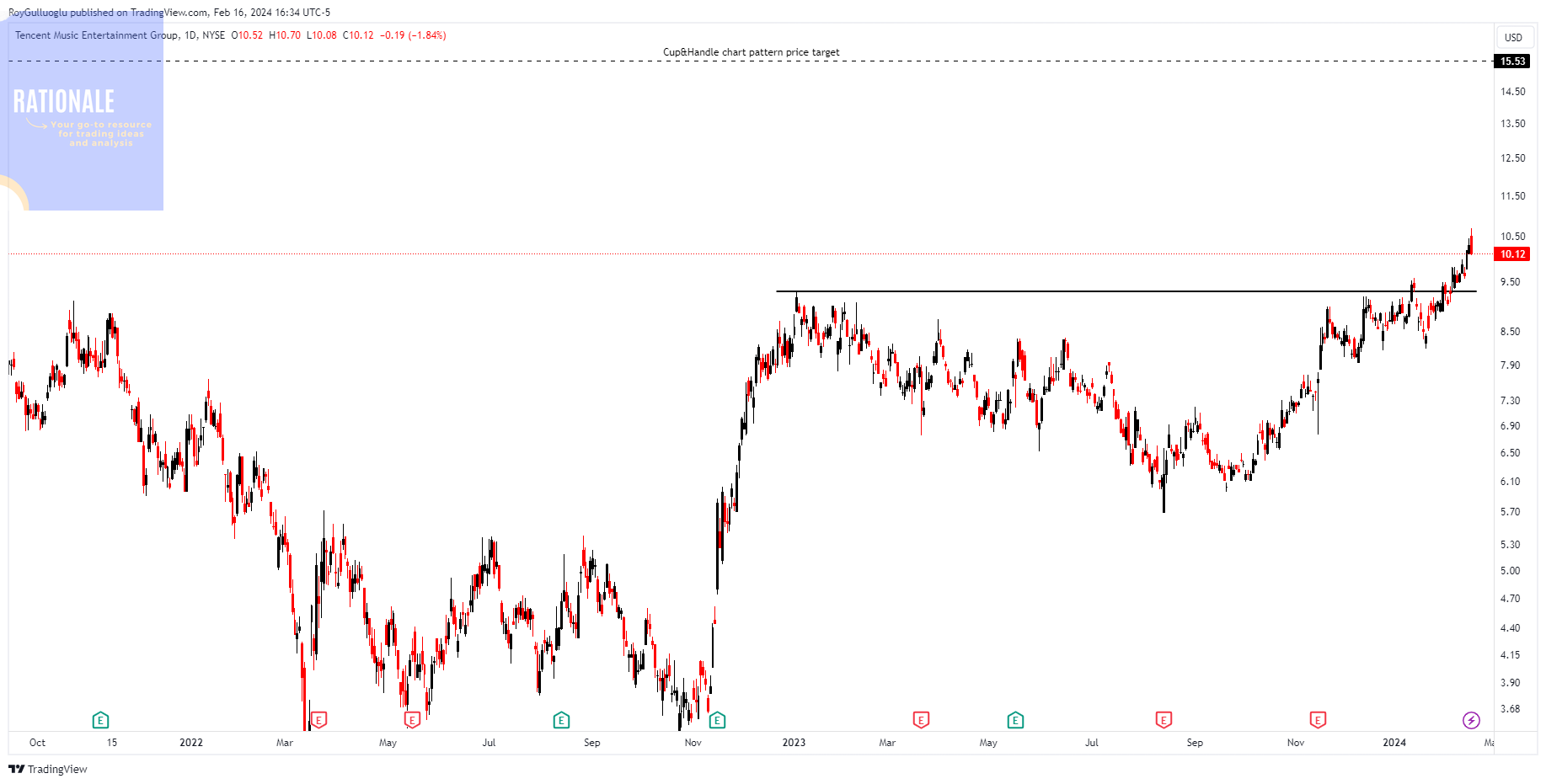

Tencent Music Entertainment Group-(TME/NYSE)-Long Idea

Tencent Music Entertainment Group manages online music entertainment platforms, offering services such as music streaming, online karaoke, and live streaming in the People's Republic of China.

The above daily chart formed an approximately 9-month-long Cup & Handle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 9.3 levels acted as a resistance within this pattern.

A daily close above 9.58 levels validated the breakout from the 49-month-long Cup & Handle chart pattern.

Based on this chart pattern, the potential price target is 15.5 levels.

PG, classified under the "communication services" sector, falls under the “Large Cap - Growth” stock category.

Delek US Holdings, Inc.-(DK/NYSE)-Long Idea

Delek US Holdings, Inc. is involved in the integrated downstream energy sector in the United States, operating through three main segments: Refining, Logistics, and Retail. In the Refining segment, the company processes crude oil and other feedstock to produce a range of petroleum-based products, including gasoline, diesel fuel, aviation fuel, asphalt, and more. These products are distributed through both owned and third-party product terminals.

The above daily chart formed an approximately 3-month-long rectangle chart pattern.

The horizontal boundary at 27.88 levels acted as a resistance within this pattern.

A daily close above 28.7 levels validated the breakout from the 3-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 32 levels.

A potential price action may lead to a breakout from a 6-years-long downtrend as you can see in the below weekly graph.

DK, classified under the "energy" sector, falls under the “Small Cap - Income” stock category.

Follow-ups

Diamondback Energy, Inc-(FANG/NYSE)-Long Idea

You can click the FANG ticker above to access the first report explaining the RATIONALE behind the trade idea.

Weatherford International plc-(WFRD/NASDAQ)-Long Idea

You can click the WFRD ticker above to access the first report explaining the RATIONALE behind the trade idea.

Blackstone Secured Lending Fund-(BXSL/NYSE)-Long Idea

You can click the BXSL ticker above to access the first report explaining the RATIONALE behind the trade idea.

Frontline Plc-(FRO/NYSE)-Long Idea

You can click the FRO ticker above to access the first report explaining the RATIONALE behind the trade idea.

Sun Life Financial, Inc.-(SLF/NYSE) - Long Idea

You can click the SLF ticker above to access the first report explaining the RATIONALE behind the trade idea.