New setups

TICKERS: FE(NYSE), AAPL(NASDAQ), BBWI(NYSE), ODFL(NASDAQ), MC(NYSE), 601166(SSE), 600104(SSE), 603529(SSE)

FirstEnergy Corp.-(FE/NYSE)-Long Idea

FirstEnergy Corp., operating via its subsidiaries, produces, transports, and disperses electricity across the United States. It divides its operations into Regulated Distribution and Regulated Transmission segments. The corporation possesses and manages coal-fired, nuclear, hydroelectric, wind, and solar power plants.

The above daily chart formed an approximately 3-month-long rectangle chart pattern.

The horizontal boundary at 38.7 levels acts as a resistance within this pattern.

A daily close below 39.8 levels would validate the breakdown from the 3-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 41.8 levels.

FE, classified under the "utilities" sector, falls under the “Large Cap - Income” stock category.

Apple Inc.-(AAPL/NASDAQ)-Short Idea

Apple Inc. crafts, produces, and promotes smartphones, personal computers, tablets, wearables, and accessories globally.

The above daily chart formed an approximately 6-month-long rectangle chart pattern as a bearish reversal after an uptrend.

The horizontal boundary at 167.15 levels acts as a support within this pattern.

A daily close below 162.2 levels would validate the breakdown from the 6-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 143.4 levels.

AAPL, classified under the "technology" sector, falls under the “Large Cap - Growth” stock category.

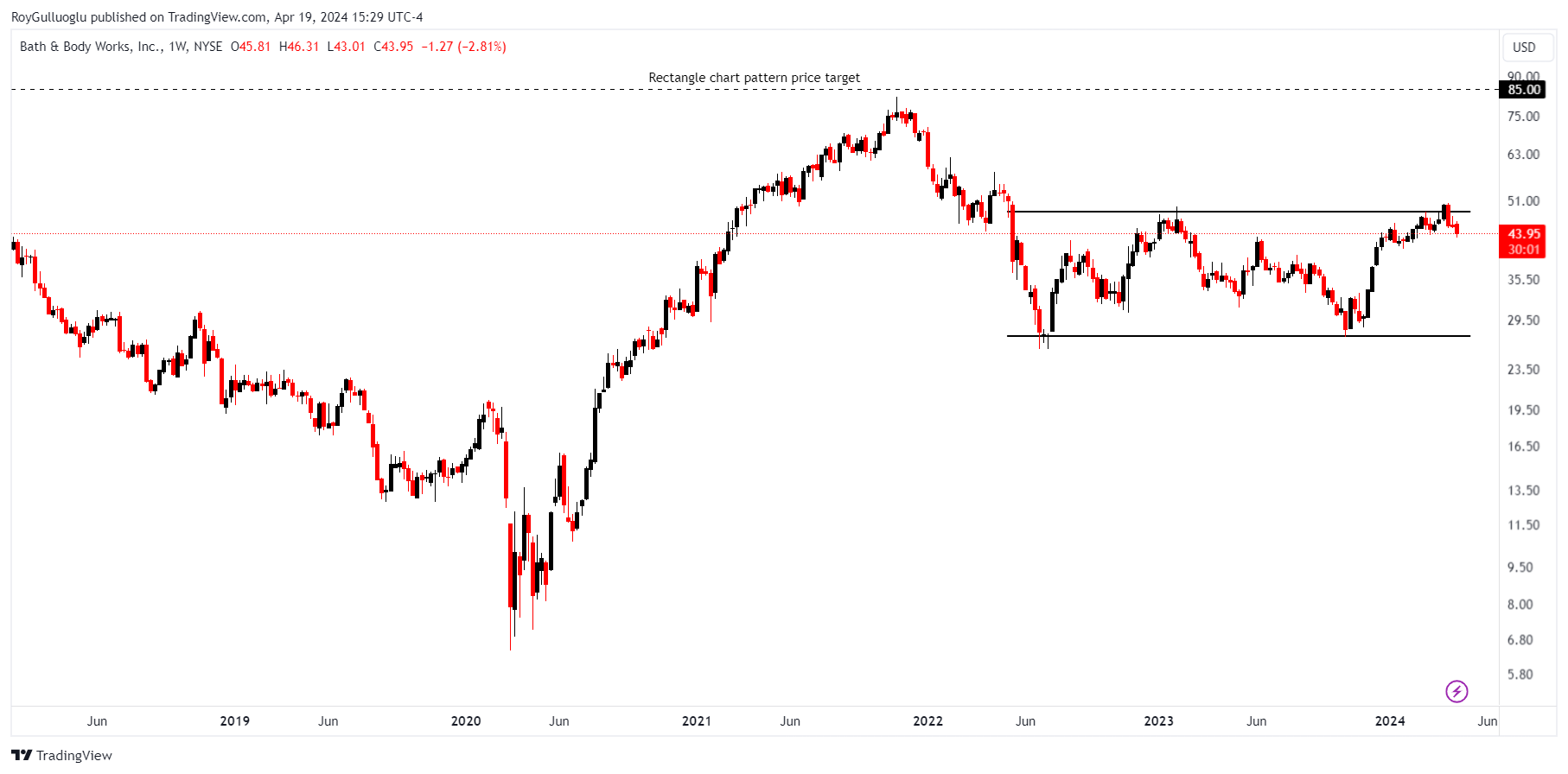

Bath & Body Works, Inc.-(BBWI/NYSE)-Long Idea

Bath & Body Works, Inc. runs a specialized retail business focused on home fragrance, body care, and soap and sanitizer products.

The above weekly chart formed an approximately 22-month-long rectangle chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 48.5 levels acts as a resistance within this pattern.

A daily close above 49.95 levels would validate the breakout from the 22-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 85 levels.

BBWI, classified under the "consumer cyclical" sector, falls under the “Mid Cap - Growth” stock category.

Old Dominion Freight Line, Inc.-(ODFL/NASDAQ)-Long/Short Idea

Old Dominion Freight Line, Inc. is a less-than-truckload motor carrier operating in the United States and North America. The corporation provides regional, inter-regional, and national less-than-truckload services, alongside expedited transportation options.

The above daily chart formed an approximately 2-month-long rectangle chart pattern.

Within this pattern, the horizontal boundary at 226.2 levels acts as a resistance, and at 208.26 levels acts as a support.

A daily close above 232.9 levels would validate the breakout from the 2-month-long rectangle chart pattern. Also, a daily close below 202.01 would validate the breakdown from the rectangle top reversal chart pattern.

Based on these chart patterns, the potential price target is at 245 and 192 levels respectively.

ODFL, classified under the "industrial" sector, falls under the “Large Cap - Value” stock category.

Moelis & Company-(MC/NYSE)-Short Idea

Moelis & Company functions as a firm providing investment banking advisory services. Its offerings span mergers and acquisitions, recapitalizations and restructurings, capital markets transactions, and various corporate finance matters. Additionally, it provides strategic advice, capital structure guidance, and private funds advisory services.

The above daily chart formed an approximately 3-month-long rectangle chart pattern as a bearish reversal after an uptrend.

The horizontal boundary at 51.71 levels acts as a support within this pattern.

A daily close below 50.16 levels would validate the breakdown from the 3-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 46 levels.

MC, classified under the "financial services" sector, falls under the “Mid Cap - Income” stock category.

Industrial Bank Co., Ltd.-(601166/SSE)-Long Idea

Industrial Bank Co., Ltd. offers banking services within the People's Republic of China.

The above daily chart formed an approximately 7-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 16.85 levels acts as a resistance within this pattern.

A daily close above 17.35 levels would validate the breakout from the 7-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is 20 levels.

601166, classified under the "financial services" sector, falls under the “Large Cap - Income” stock category.

SAIC Motor Corp Ltd-(600104/SSE)-Long Idea

SAIC Motor Corporation Limited engages in research and development, manufacturing, and sales of passenger and commercial vehicles both domestically in the People's Republic of China and globally.

The above daily chart formed an approximately 7-month-long rectangle chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 15.65 levels acts as a resistance within this pattern.

A daily close above 16.11 levels would validate the breakout from the 7-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is 18.5 levels.

600104, classified under the "consumer cyclical" sector, falls under the “Large Cap - Growth” stock category.

AIMA Technology Group CO., LTD-(603529/SSE)-Long Idea

AIMA Technology Group CO., LTD is involved in the research and development, manufacturing, and global distribution of electric bicycles, mopeds, and motorcycles, operating primarily in China.

The above daily chart formed an approximately 7-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 34.22 levels acts as a resistance within this pattern.

A daily close above 35.24 levels would validate the breakout from the 7-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is 47 levels.

603529, classified under the "consumer cyclical" sector, falls under the “Mid Cap - Growth” stock category.

Thnx