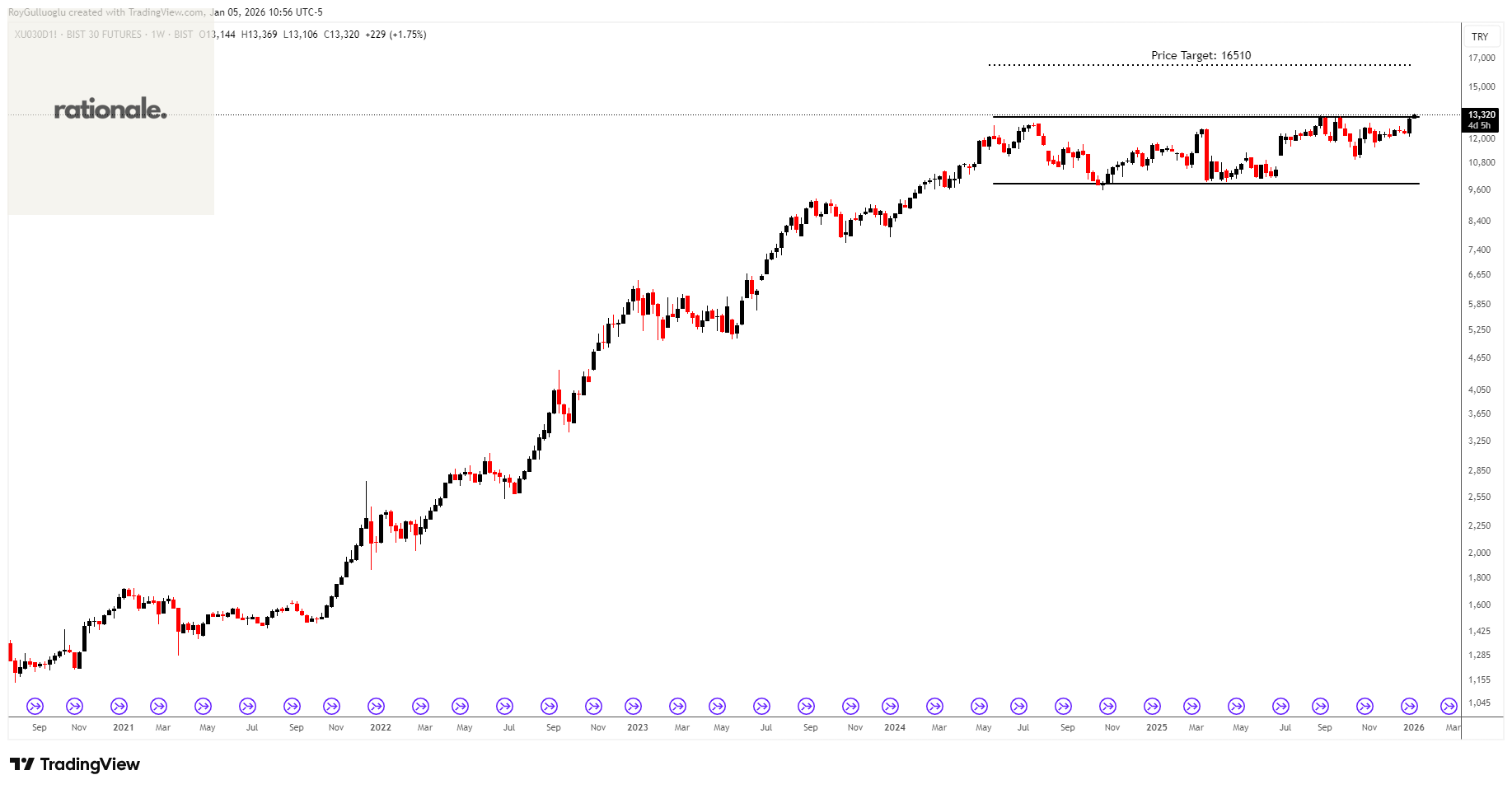

XU030D1!(BIST30 Futures)-Long Idea

The above daily chart formed an approximately 3-month-long rectangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 13200 levels acts as a resistance within this pattern.

A daily close above 13332 levels would validate the breakout from the 3-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is approximately 16510 levels.

Risk-on EM environment favors high beta markets. Valuations remain attractive relative to global peers. BIST30 stocks trade at a significant discount to developed and many emerging market indices, leaving room for multiple expansion if confidence improves.

FRA40(CAC40 CFD)-Long Idea

The above daily chart formed an approximately 3-month-long rectangle chart pattern as a bullish continuation after an uptrend.

The horizontal boundary at 8271 levels acts as a resistance within this pattern.

A daily close above 8353 levels would validate the breakout from the 3-month-long rectangle chart pattern.

Based on this chart pattern, the potential price target is approximately 9700 levels.

At the Eurozone level, GDP growth has stabilized around flat to slightly positive levels while inflation continues to decelerate. This combination eases pressure on monetary policy, lowers the risk of further aggressive tightening, and supports more resilient earnings expectations for large-cap companies, particularly globally diversified firms that dominate indices such as the CAC40.

GBPUSD-Long Idea

The above daily chart formed an approximately 3-month-long H&S bottom chart pattern as a bullish reversal after a downtrend.

The horizontal boundary at 1.35352 levels acts as a resistance within this pattern.

A daily close above 1.367 levels would validate the breakout from the 3-month-long H&S bottom chart pattern.

Based on this chart pattern, the potential price target is approximately 1.4078 levels.

If the dollar weakness continues, the pound looks well positioned, supported by improving UK growth expectations that contrast with still-cautious market pricing.

Also, In an environment of steady or improving global risk appetite, sterling typically outperforms the dollar as safe-haven demand fades.

Teşekkürler Roy