Dear Rationale Members,

As we conclude 2024, I want to take this opportunity to reflect on the year’s achievements and share an overview of the journey we’ve undertaken together. This year has been remarkable, filled with dynamic market movements, and your engagement with the Rationale newsletter has been integral to its success. Let’s dive into the key highlights:

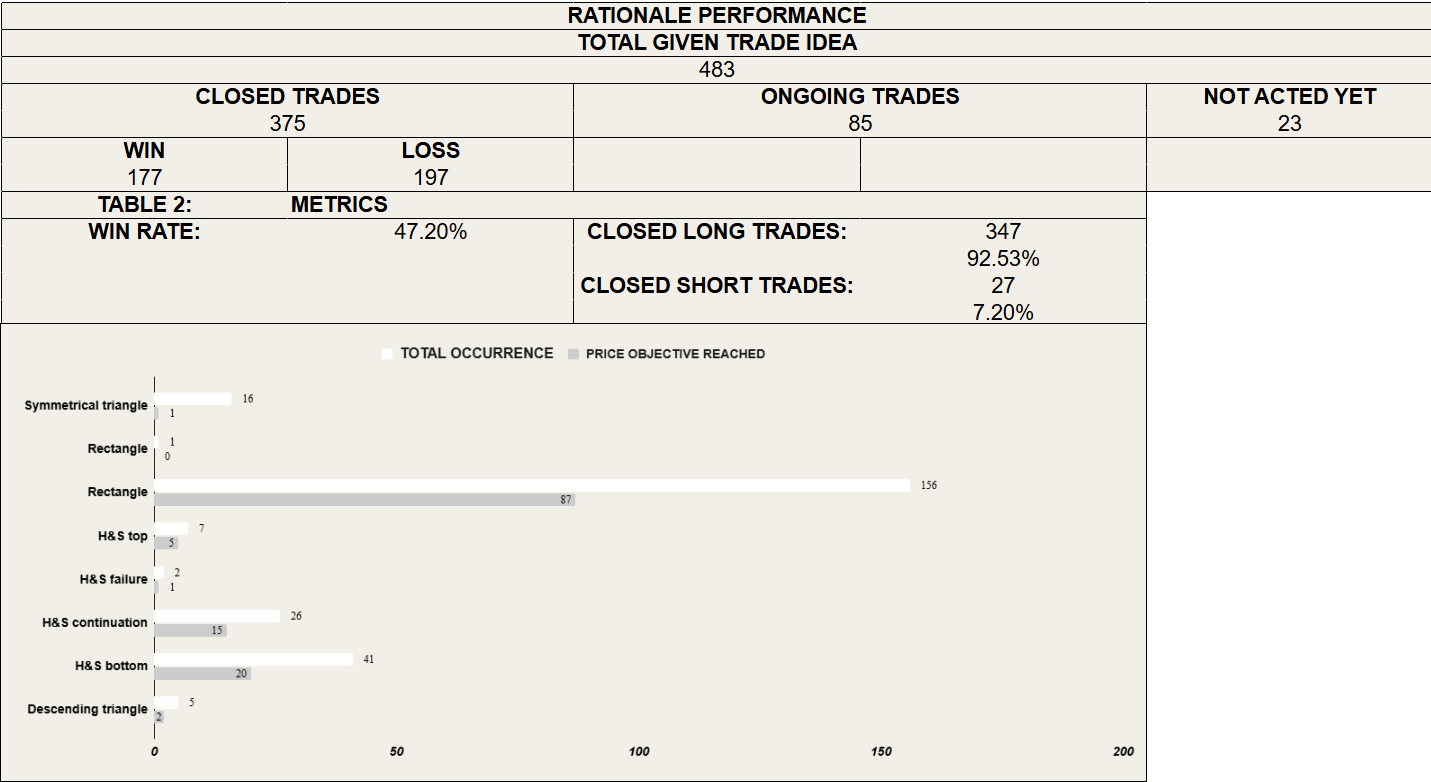

Performance Summary

You can visit Rationale Performance page to explore detailed explanations of the performance metrics for the trade ideas shared through the Rationale research service.

Find answers to questions such as: What defines a winning trade? What constitutes a losing trade? What are ongoing trade ideas? How should the win rate be evaluated? And more.

Macro Trend Trade Ideas

Several significant market trends were captured this year, offering members valuable opportunities:

Gold Long: Gold’s strong rally was identified early and turned out to be a great opportunity.

Crypto Long: The rebound in cryptocurrencies was another highlight, with the broader market offering solid gains. The reversal from the bottom was spotted in Bitcoin and a lot of other cryptocurrencies.

US Equities: Many US stocks delivered solid results, guided by classical chart patterns.

You can visit Rationale Watchlist page to see the details of given trade ideas.

Key Lessons from 2024

1. Adapting to Market Volatility:

This year underscored the importance of flexibility in the face of evolving market conditions. Whether it was navigating geopolitical uncertainties or responding to shifts in monetary policy, our strategies emphasized agility and preparedness.

2. Risk Management as a Cornerstone:

Maintaining a disciplined approach to risk management was critical. By sticking to predefined stop-loss levels and focusing on high-probability setups, we ensured consistent portfolio protection.

3. Leveraging Technical Analysis:

Our reliance on classical chart patterns and technical formations provided a reliable framework for decision-making across multiple asset classes.

Looking Ahead to 2025

The insights and lessons gained from 2024 will continue to guide the approach moving forward. Plans for 2025 include:

You can check out the final Market Update video of 2024, where I discussed strategies for structuring a portfolio ahead of 2025.

Improving the watchlist to make it easier for you to track trade ideas by increasing the frequency of Trade Alerts reports.

Sharing clear and actionable ideas to help you navigate the markets by sharing more short videos including game plans showing my approach.

Thank You for Being a Part of Rationale

Your support has been incredibly important this year. If you have any feedback or suggestions, I’d love to hear them as I work to make 2025 even better.

Wishing you a Happy New Year filled with success, growth, and new opportunities!

Warm regards,

Roy Gulluoglu

Founder, Rationale Newsletter